The 3-Minute Rule for Best Broker For Forex Trading

The 3-Minute Rule for Best Broker For Forex Trading

Blog Article

Best Broker For Forex Trading Fundamentals Explained

Table of ContentsSome Known Factual Statements About Best Broker For Forex Trading Getting My Best Broker For Forex Trading To WorkThe Best Broker For Forex Trading PDFsThe Only Guide for Best Broker For Forex Trading4 Simple Techniques For Best Broker For Forex Trading

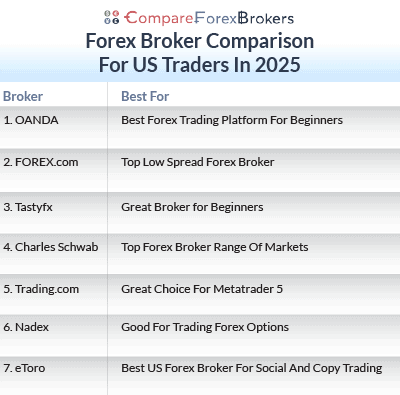

You should take into consideration whether you can pay for to take the high risk of shedding your money. In recap, it is hoped that you currently have the called for understanding to locate an on the internet foreign exchange broker that satisfies your needs. Whether it is guideline, trading fees, down payments and withdrawals, customer support, trading devices, or the spread you now recognize what to look out for when picking a new system.However, if you do not have the time to study platforms on your own, it may be worth checking out the leading 5 suggested forex brokers that we have actually discussed above. Each foreign exchange broker excels in a specific division, such as low charges, mobile trading, user-friendliness, or trust fund. Ultimately, just see to it that you recognize the risks of trading forex online.

This suggests that significant forex pairs are topped to utilize degrees of 30:1, and minors/exotics at 20:1. However, if you are an expert investor, these restrictions can go right approximately 500:1 on majors. While minimal down payments will certainly differ from broker-to-broker, this generally standards 100 in the UK. If the broker is based in the UK, after that it has to be managed by the FCA.

With such a huge market, there will certainly be constantly somebody happy to buy or sell any currency at the quoted price, making it easy to open and close professions or purchases at any kind of time of the day. There are periods of high volatility during which it might be not very easy to get a great fill.

The Definitive Guide to Best Broker For Forex Trading

But as any kind of other market, throughout durations of instability slippage is always an opportunity. Greater liquidity also makes it tough to control the market in a prolonged manner. If several of its participants attempt to control it, the individuals would call for huge quantities of money (10s of billions) making it virtually difficult.

We will discuss this in the future. The Foreign exchange market is an around the clock market. Best Broker For Forex Trading. This indicates that you can open or close any kind of position at any type of time from Sunday 5:00 pm EST (Eastern Criterion Time) when New Zealand starts operations to Friday 5:00 pm EST, when San Francisco terminates operations

Some brokers offer up to 400:1 leverage, implying that you can manage for circumstances a 100,000 United States buck purchase with simply.25% or US$ 250. If the utilize is not effectively used, this could also be a drawback.

We will go deeper in to this in the following lesson Therefore, utilizing take advantage of above 50:1 is not encouraged. Keep in mind: the margin is utilized as a deposit; whatever else is likewise at danger. The Forex market is thought about one of the markets with the most affordable costs of trading.

Our Best Broker For Forex Trading Ideas

There are 2 key gamers you can not bypass in the foreign exchange (FX) market, the liquidity carriers and brokers. While brokers link traders to liquidity carriers and implement trades on behalf of the traders.

Brokers are individuals or companies who stand for traders to get and market possessions. Think about them as middlemans, facilitating transactions in between investors and LPs. Without them, investors would come across problem with transactions and the smooth flow of trade. Every broker needs to acquire a permit. They are controlled by economic regulatory bodies, there are over 100 governing bodies worldwide, these bodies have varying degrees of focus and authority.

The Definitive Guide for Best Broker For Forex Trading

After the events agree, the broker forwards the LP's offer to the trader. As soon as the cost and terms are satisfying, the profession is executed, and the possession is moved. To sum up the symbiotic dance, each event take their share of the made cost. Online brokers charge the read this trader a compensation while LPs make profits when they purchase or offer assets at rewarding prices.

Electronic Interaction Networks (ECNs) connect traders to numerous LPs, they offer affordable prices and transparent execution. Right here the broker itself acts as the LP, in this version, the broker takes the opposite side of the trade.

When both parties are on the very same web page, the partnership in between the 2 is usually helpful. A collaboration with LPs makes it easier for brokers to meet numerous profession proposals, generating even more clients and improving their company. When on-line brokers access numerous LPs, they can use affordable rates to investors which improves increased client complete satisfaction and loyalty.

6 Easy Facts About Best Broker For Forex Trading Shown

Let's dive into the vital locations where this partnership shines. This collaboration assists to broaden the broker's capital base and permits them to provide bigger profession sizes and provide to institutional customers with significant financial investment requirements. It also widens LPs' reach with verified broker that site networks, thus giving the LPs accessibility to a broader puddle of possible clients.

Report this page